Over the past years, I’ve seen people come up with a lot of excuses and reasons why “it doesn’t work”.

Maybe you’re afraid you’ll end up as “one of those people who’ll never be rich” — am I right?

And you’re thinking: “What can I do to avoid this? Because I really want to be rich!” Well — Here you have your answers. Let’s dive in.

1. Not setting financials goals

Everything starts with setting goals. What do you want to achieve? Where do you want to be in 1, 2, .. 5 years?

If you don’t set a direction of where you want to go in life, then how will you ever achieve it?

Recently I was talking to a friend of mine. We were talking about travelling etc, and he was a bit jealous of how I’m travelling so much & often.

“How do you do it?”, he asked. “You must really be rich… I’m not able to do it because I just don’t have enough money.”

In return I asked him a bunch of questions…I asked him about his financial habits, savings plans, and how he prioritizes his spending. It turned out that he hadn’t really thought about setting aside money specifically for travel or any other goals. He lived paycheck to paycheck, spending almost everything he earned without much thought for the future.

“I just handle things as they come,” he admitted, shrugging. “I guess I’ve never really thought about planning ahead for things I want.”

“That’s exactly why you feel stuck,” I told him. “Without setting clear financial goals and planning how to achieve them, it’s easy to feel like your dreams are out of reach. But the truth is, with a bit of planning and discipline, you can make a lot of things happen, including traveling.”

I shared with him how I started with small, manageable financial goals and gradually worked my way up. I explained the importance of budgeting, saving a portion of each paycheck, and looking for ways to reduce unnecessary expenses. I also talked about setting aside a ‘travel fund’ and how rewarding it was to watch it grow over time.

“It’s not about being rich,” I told him. “It’s about being strategic with what you have. Anyone can travel with the right planning and priorities.”

Our conversation ended with him feeling more hopeful and motivated. He realized that achieving his travel dreams — and other goals — was possible with some adjustments to his financial habits.

Based on this story, here are five specific and challenging questions you can ask yourself, to help you reflect and potentially change your perspective towards achieving your dreams:

- Reflect on Your Priorities: Looking at your current spending habits, what are your top three financial priorities, and how do they align with your long-term goals, like traveling?

- Goal Setting: Can you identify one short-term and one long-term financial goal that would make a significant impact on your life? How do these goals contribute to your overall happiness and fulfilment?

- Budgeting Strategy: What is your current approach to budgeting, and how can you adjust it to better accommodate saving for your goals? Are there specific areas where you can cut back without significantly impacting your quality of life? If you’re not budgeting yet, start with this first.

- Savings Plan: What specific steps can you take to start a savings plan for your travel fund or any other big goal? How much do you need to save each month to reach this goal within a realistic timeframe?

- Accountability and Motivation: How can you hold yourself accountable to these financial goals, and what can you do to stay motivated, especially when faced with setbacks or temptations to divert from your plan? Who of your friends or family will you tell about your goals, to help support you?

I know, these might seem like annoying questions to you, but trust me — they encourage deep reflection and inspire a proactive approach to financial planning and goal achievement.

2. Believing a 9–5 Job is the only way to earn money

If you’ve been reading my articles, you hopefully know that this is NOT the only way.

With just my day job, I wouldn’t be able to live the life that I currently live. I wouldn’t be able to invest money in stocks, real estate, crypto — all while travelling and enjoying life.

There are countless of opportunities that you can chase to earn (more) money. I have just chosen the following few:

- Print on Demand

- YouTube Automation

- Blogging

- Affiliate Marketing

- Real estate & Rental income

- Airbnb

Choosing the right side hustle or income stream can seem difficult, especially with so many options available. But the key is to start with self-reflection to understand what resonates with you personally. Here are some questions to guide that exploration:

- Skills and Passion Intersect: What are the skills you possess that others often seek your help for, and how do these overlap with activities you’re deeply passionate about? Can you think of a way to monetize this intersection?

- Market Needs: Have you identified a gap in the market or a specific need that you are uniquely positioned to fill with your skills, knowledge, or passions? How can this insight shape your choice of a side hustle?

- Learning and Growth: Which potential side hustle excites you the most when you think about the learning curve and the growth opportunities it presents? How does this align with your personal and professional development goals?

- Lifestyle Compatibility: Think about your current lifestyle. How would different side hustles fit into that vision in terms of time commitment, flexibility, and potential income? Are there any that particularly stand out as being more compatible than others?

- Experimentation and Feedback: What small experiment can you conduct in the next 30 days to test out a side hustle idea that interests you? How will you measure success, and what criteria will you use to decide whether to pursue it further or pivot?

So, what will you do to escape the “rat race”?

3. Not keeping track of your expenses

This one may seem very obvious, but trust me — SO MANY people fail with this.

Let’s go back to the story of my friend.

After explaining him a bit about goalsetting and budgeting, I encouraged him to keep track of his income and expenses.

I told him to create an excel sheet where he should:

- Keep track of ALL his income

- Keep track of ALL his expenses

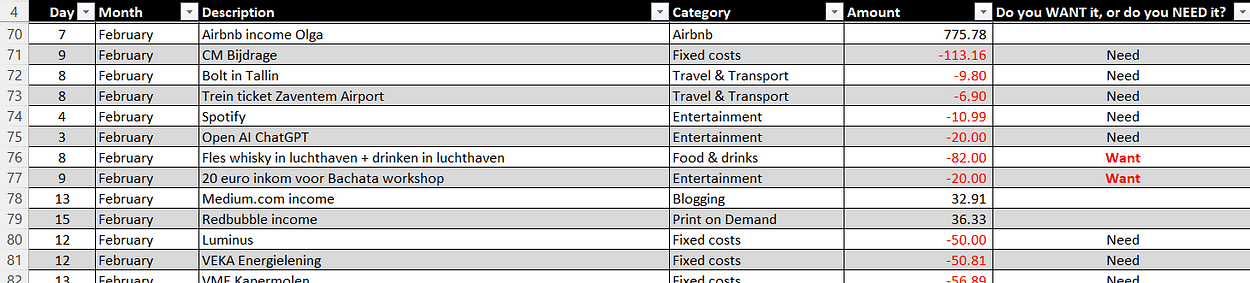

Something like this:

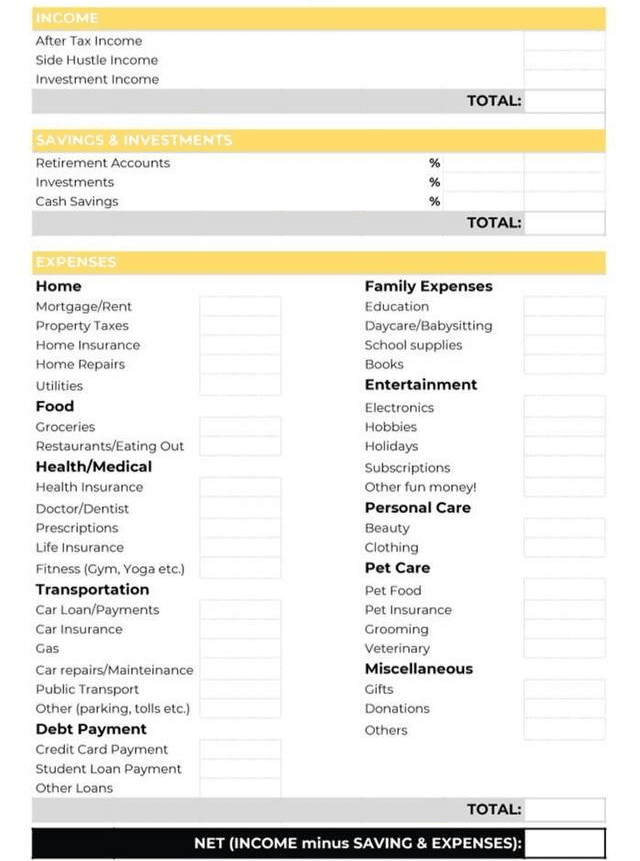

Or even simpler:

He took my advice and started putting ALL of his expenses in an Excel sheet.

- All of his subscriptions

- All of his costs

- All of his spendings

- … everything

After a week, he called me up: “Dude, I’m paying more than €300 a year service costs to my banks, wtf!”

To some of you, this might seem unbelievable. “How can a person not know how much costs he pays?”

Well, it might surprise you, but… it happens more than you think.

Anyway, I advised my friend to put “WANT” or “NEED” behind every expense that he made. This way, he’d know whether this was really a necessary expense, or just something he wanted — a luxury.

After 1 month, he was able to cut his monthly costs with 276 EUR. He cancelled some unused subscriptions, he was thinking more about whether he should or shouldn’t buy stuff — but most importantly: He now has INSIGHTS into his FINANCIAL SITUATION!

With this foundation, he’ll be able to get much further:

- He’ll have more money to save

- He’ll have more money to invest

And most importantly , it actually made him think about ways on “how he can earn more money”. “How can I increase my income?”

4. Not learning new things

If you don’t take any steps to improve, you’ll most likely forever stay where you are now.

Of course, if you’re happy with where you are today, then OK. However, I suppose if you were 100% satisfied, then you wouldn’t be reading this.

Always keep learning new things. Be on the lookout for new opportunities. Share knowledge. Be friendly. Read that book. Appreciate what you’ve already achieved. Smile. Aim to become 1% better every day.

“The only person you should try to beat, is the person you were yesterday.”

5. Focusing on saving instead of earning

A while ago I wrote an interesting article about this:

The core of this article is, well, the title.

It’s definitely easier to earn money than it is to save money.

Don’t believe me?

- Try to save 10k → How much time do you need? (12 months?)

- Try to earn 10k → Goes much faster, doesn’t it? (3 months?)

If people come to me, saying “dude, I wanna travel as much as you do, but I’m already struggling to meet month’s end”. If they are budgeting, optimizing their spending, cutting their expenses — and still are not able to save money, then they’re simply not earning enough.

Here in Belgium, if you’ve got a paycheck of 2k / month, a mortgage of €1200 / month, and €800 monthly expenses for food, bills etc, then yeah — I’d say their mortgage is too heavy and they better sell their property.

Alternatively, they could find ways to make more money. Start a side hustle. Aim for promotions at work. Switch jobs. Anything is possible, if you have the right mindset.

6. Being too scared of failure to try anything

Oh this is one I’ve been guilty of as well in the past.

I’ve always been a careful person. Always playing it safe. Not risking anything. And truth be told — I actually haven’t changed much.

I always make sure that I have a steady foundation to fall back on, but all the rest is “extra and experiments”.

I’m running a bunch of side hustles now, some of them more successful than others. Some have even failed epically. But in the end, I always come out as a better person. I’ve learned. I’ve grown.

If you’re always focusing on the impossible instead of the possible, you’ll never achieve anything.

Same with excuses. Excuses don’t build empires.

7. Failing to make investments

My 7th and final reason of why you will stay poor, is if you do not make any investments.

And with investments, I’m not only talking about stocks, crypto, commodities or so. I’m also talking about yourself.

Your own knowledge and skills are the best investment. YOU are the best investment. Invest in yourself. That is step #1.

When that’s done, then you can start looking into the other investment opportunities.

Why only then? → How are you going to invest into the crypto market if you don’t know anything about it? If you’ve never heard about ETF’s or exchanges or DCA? How will you buy a good property?

Once you’ve understood the concept of investing, you’re truly on your path to a richer, wealthier life.

Wealth doesn’t come from working hard, it comes from investing smart.

So, what will be YOUR first investment?

Conclusion

Did you recognize any of these seven pitfalls that possibly hinder your financial success?

If yes, it’s important to take steps to avoid them. Address these challenges head-on, set clear goals, diversify income streams, monitor expenses, embrace growth opportunities, overcome the fear of failure, initiate investments, and consistently invest in personal growth and development.

By taking proactive steps to overcome these obstacles, YOU can pave the way toward financial abundance and fulfilment.

Thanks for reading!

If you’ve got questions or thoughts, drop them in the comments and I’ll get back to you! Follow or ???? if you’d like to see more content like this. Or buy me a coffee, this stuff is magical 😉

P.S. did you claim your copy of my free e-book yet?