How To Achieve that RICH Dream Life You Always Wanted

What is Financial Freedom?

Some definitions:

Financial freedom is the state of having enough financial resources, savings, and investments to afford the lifestyle you desire, without having to work every day for a specific income.

—

Financial freedom means to be financially free to do whatever you want, whenever you want.

—

Attaining financial freedom is a shared dream / goal for many individuals. In practice, it means:

- Having the necessary savings, investments, and financial resources to support the lifestyle we desire for ourselves and our loved ones.

- Having the financial possibility that grants us the freedom to retire comfortably or pursue our dream career, unencumbered by the need to meet specific income targets each year.

Attaining financial freedom

Unfortunately, most people struggle to realize this goal.

I also failed countless times in the past. Let me give you a few reasons:

- Debt

- Unexpected costs

- Financial crises

- Excessive spending

- No financial intelligence

- …

There are countless of reasons that can disrupt our awesome plans.

However, I didn’t give up and today I am proud to say that I am ALMOST financially free.

Here are 12 habits that I’ve learned and applied to set myself on the right course towards financial stability:

1. Set Clear Goals

Everything starts with defining goals and financial objectives. Once you know where you want to be, you can establish a roadmap for achieving them.

A tip here: Don’t think small, but think big.

For example — my personal goal this year is earn 100k from side hustles, invest everything in stocks, gold, silver, crypto currencies, and expect a huge return in 1–2 years.

With this return, I’m planning to buy condo’s. Not just 1, but at least 5–10.

Big goals? Yes. Achievable? I believe I’m well on my way.

And even if I don’t reach them… I probably won’t be far off because I’m doing everything I can to get this 100k!

2. Budget

You just have to learn to work with money.

If you can’t manage your money, you’ll always be poor.

Develop a well-structured budget that aligns with your goals and provides guidance for your spending and saving habits.

Just like my “Earn 100k goal”, I set myself also investment and savings goals.

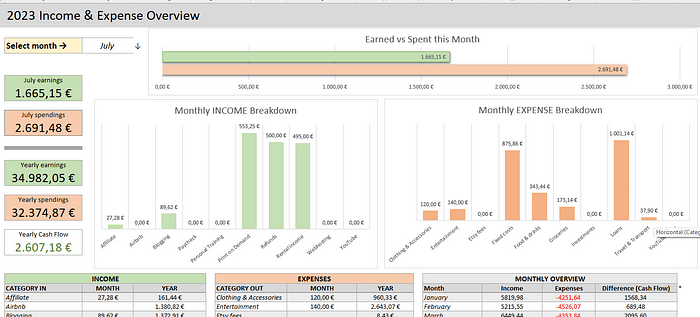

You can use some trackers for this, make it yourself or just buy one. For example, I made this one myself:

In case you’re interested, you can get it here for just $2.

3. Prioritize Debt Management

Get rid of those debts, or make a plan on how to do so.

You have to confront them head-on and implement strategies to reduce and eliminate them effectively.

Get started with the debts that have the highest interest rates. You need to tackle these first, because they’ll cost you more in the long run.

4. Have an emergency Fund

You never know what might happen tomorrow.

You car could break down. A nature disaster might happen. You or a family member might get sick and need medical care.

There can be countless of reasons that might require you to spend some “emergency cash”.

So be ready for it.

5. Live Below Your Means

I know people that earn 10k per month, and yet they still complain that they don’t have enough money, that they struggle to meet month’s end.

On the other hand, I know people that earn as a couple a total of $3000, and they are able to manage alright.

So where’s the difference?

It’s usually a combination of unneeded luxury, debts, no financial awareness, clueless spending and more.

Tip: Write down EVERYTHING that you spend or earn. Then at the end of the month, have a good look at your list and start cutting (tip: you can do that PERFECTLY with this)

Cut out things that you didn’t really need, but just… “wanted”. Don’t buy these things next month.

Or go shopping at a cheaper store, find discounts, cook your own food (instead of take-away)…

Once you make this financial list, it will be become obvious. You’ll figure it out.

6. Continuous Learning

The world never stops. These days it’s AI that’s starting to dominate everything, but what will it be tomorrow? So the best thing you can do is… continue evolving as well.

Stay on top with the newest trends, knowledge, courses…

Your first priority should be improving your financial education, by staying informed about personal finance strategies and market trends.

For example, I recently bought a Print on Demand Course (this one) — it’s quite pricy but after 2 months I already made back my investment. So in my opinion, it was worth it. But of course, always do your own research.

7. Diversify Your Investments

Never put all your eggs in one basket.

Today, cryptocurrency might go through the roof, but tomorrow it might crash. Be prepared and informed. Spread your risks.

You’ve hopefully learned about nice investment opportunities in tip #5, so let’s say you have $10,000 to invest, it would be wise to, for example, do the following:

- 2500 in crypto

- 2500 in stocks

- 2500 in commodities

- 2500 in anything else you believe in.

Don’t spend your money all at once, but spread it over time.

This is called “Dollar Cost Averaging”. Google the definition if you’d like to learn more, but basically it just means… repeatedly buying for a small amount, over a long period of time.

For example, that $2500 for crypto: buy for $500 every week. Or perhaps even $100 every 3 days. And don’t think, just buy. Whether the market is up or down, just stick to your plan.

In the end, you’ll win.

P.S. when searching for investment opportunities, always be careful — if something sounds too good to be true, it usually is.

8. Automate

This can be applied to many things, but I use it mainly for my finances.

Automate your investments, this will help A LOT!

Some things that I automated:

- Automated recurring buys of Bitcoin & Silver via Revolut

- Automated other crypto investments (+diversification) via Iconomi.

- Cleaning (I hired a cleaning lady to clean my apartment every week, which saves me a lot of time AND keeps my place clean of course). She also helps me to take care of my Airbnb business.

- Affiliate website creation — I hired a guy (via Fiverr) to fix some things on my own website that would cost me too much time to do it myself

- YouTube video creation (also via Fiverr)

- Print on Demand design creation & uploading via MyDesigns.io

- …

9. Diversify Your Income

Never depend on a single source of income.

This reminds me of one of my favourite quotes:

“If you only have 1 source of income, you’re 1 step away from poverty.”

Personally, I’m doing the following:

- Normal job income

- Print on demand sales income

- Rental income

- Airbnb income

- Blogging income

- Affiliate income

- Crypto staking income

- Royalty income (amazon KDP)

- Online sales from web shops

- Personal training & health coaching

- ….

Whatever you do, there are thousands of ways to generate multiple income streams and diversify your financial resources.

“The average millionaire has 7 sources of income.”

10. Review and Adjust

Regularly review your financial progress.

Your plans and goals might change, so you’ll have to adjust your financial plans as well. Things always change, so make necessary adjustments to stay on track.

11. Seek Professional Advice

Let’s say that you’re earning a REALLY good amount of money.

You can then of course do everything yourself, but seriously… if you’re earning hundreds of thousands of dollars per year, it would be wise to consult with financial advisors, experts and especially tax advisors.

They can give you advice, tailored to your specific circumstances and often give you tips that you never would think about.

For example, did you know you can get loans while only paying interest (called bullet loans)?

Or, did you know it’s possible to get a loan with a stock portfolio — or even Bitcoin — as a down payment?! Interesting, right?

12. Just get started

My story started in 2016. Before this, I was constantly dreaming about a wealthy lifestyle, thinking how I could achieve it.

I was making plans, calculations, talking with friends about it… and every time, something or someone “advised against it”.

- “The market is not right or saturated”

- “The risks are too high”

- “The profit is not high enough”

- “It’s too much work for too little gain”

- …

This went on for a long time, until at some point I finally got started with Print on Demand.

Even though my friends were not positive about it (with the same excuses as above), I start creating designs and uploading them.

I just got started, ignoring what they said.

And now, after a few years, I’m comfortably making $1000 extra per month with it. Nice, right?

13. Be consistent

Success won’t happen overnight.

In the beginning, I was creating (terrible) designs, and started uploading them to Redbubble, Teepublic and Displate.

I was doing this for months, with barely any results.

However, I kept going, and now — many years later — all my time and effort is paying off.

I’m earning a steady income per month, all thanks to my consistency (and stubbornness) back then.

15. Surround yourself with the right people

I can’t stress the importance of this enough.

If I’d be hanging around with unmotivated, lazy, poor, bad people… I’d probably have become one of them.

Your environment shapes you.

If you have 5 millionaire friends, you’ll be the 6th.

Sometimes, this means you’ll have to make hard decisions, cut out friends, move away to another city… whatever is necessary.

Be like a bottle of water. It costs $0.50 in the supermarket, $2 in a bar, but $10 in a fancy club in Ibiza.

The environment determines its value. Be like that bottle of water.

If you feel undervalued, unsupported, lost… it’s not you. It’s your surroundings. Get out of there.

16. Live a healthy lifestyle

This might actually be the most important habit of all.

How will you get the motivation and energy to REALLY change your life, if you’re not even taking care of yourself?

Sleep early. Eat healthy. Get up early. Make your bed. Go to gym. Work out. Smile. Eat your vegetables. Meditate. Read. Take walks. Relax. Focus.

Plus, on the other side… what good would it be to have money and financial freedom, if you’re not healthy enough to enjoy it all?

Trust me, work on your healthy habits first.

If necessary, I’d even recommend to consult with a nutrition expert or hire a personal trainer if you can afford it.

Or, if you have enough self discipline: do it yourself, possibly with the help of some books, influencers or Youtubers. Whatever works for you.

KEY TAKEAWAYS ????

I know, these are quite a lot of habits.

Don’t try to get them all at once. Get started where you are now. Analyse your life, see in which areas you can improve and start there.

Step by step, start incorporating these habits into your financial journey, until you achieve financial freedom and are able to secure a bright future for yourself and your loved ones.

Good luck!

Did you know? I also write about different passive income streams like Print on Demand, YouTube Automation, investing tips, healthy habits and just keeping yourself motivated to keep going every day!

P.S. Don’t forget to get your Financial Improvement Tracker Worksheet here!